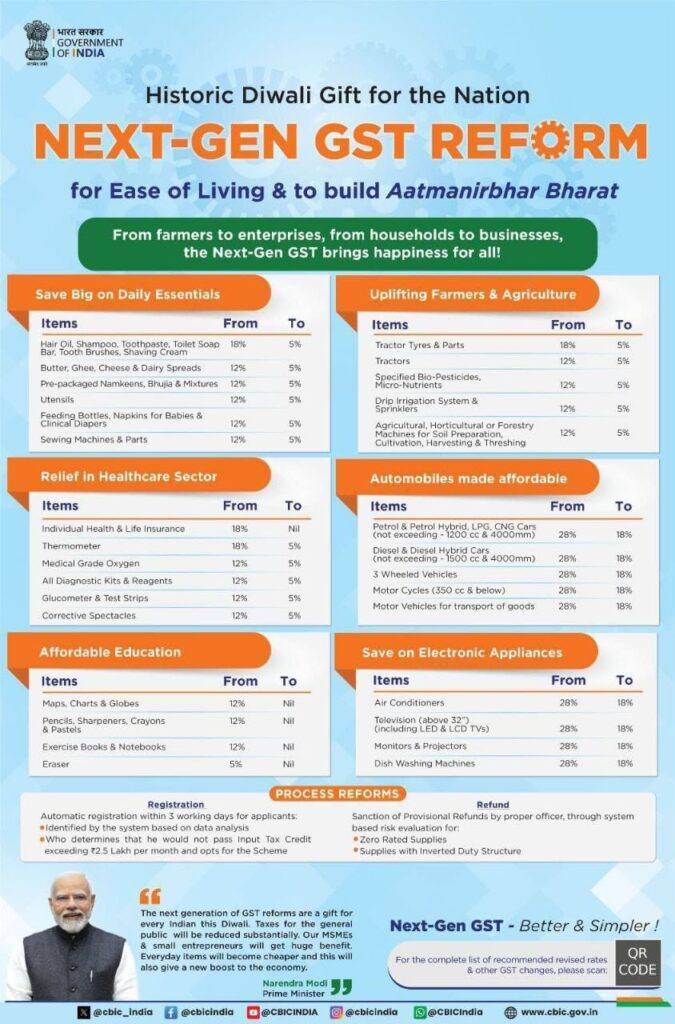

The Government of India has introduced the Next-Gen GST Reform 2025, a historic move aimed at reducing the cost of living, boosting agriculture, making healthcare more affordable, and supporting industries. These reforms touch almost every sector of the economy, from farmers and households to businesses and enterprises. By lowering GST rates on essential goods and services, the government is expected to give a significant boost to the economy, empower small entrepreneurs, and provide relief to the common man.

Industry-Wise GST Rate Revisions

| Sector | Items | Old GST Rate | New GST Rate | Impact |

|---|---|---|---|---|

| Daily Essentials | Hair Oil, Shampoo, Toothpaste, Toilet Soap Bar, Tooth Brushes, Shaving Cream | 18% | 5% | Lower cost of hygiene products |

| Butter, Ghee, Cheese & Dairy Spreads | 12% | 5% | Affordable dairy products | |

| Pre-packaged Namkeens, Bhujia & Mixtures | 12% | 5% | Snack items cheaper | |

| Utensils | 12% | 5% | Lower kitchen expenses | |

| Feeding Bottles, Napkins for Babies & Clinical Diapers | 12% | 5% | Relief for parents | |

| Sewing Machines & Parts | 12% | 5% | Boost for small tailoring businesses | |

| Agriculture | Tractor Tyres & Parts | 18% | 5% | Reduced farming costs |

| Tractors | 12% | 5% | Affordable farm machinery | |

| Specified Bio-Pesticides, Micro-Nutrients | 12% | 5% | Cheaper crop protection | |

| Drip Irrigation Systems & Sprinklers | 12% | 5% | Push for modern irrigation | |

| Agricultural, Horticultural & Forestry Machines | 12% | 5% | Support for mechanized farming | |

| Healthcare | Individual Health & Life Insurance | 18% | Nil | Affordable insurance |

| Thermometers | 18% | 5% | Essential medical devices cheaper | |

| Medical Grade Oxygen | 12% | 5% | Lower hospital costs | |

| Diagnostic Kits & Reagents | 12% | 5% | Affordable testing | |

| Glucometer & Test Strips | 12% | 5% | Support for diabetes patients | |

| Corrective Spectacles | 12% | 5% | Relief in vision care | |

| Automobiles | Petrol & Diesel Hybrid Cars (within cc limits) | 28% | 18% | Boost for eco-friendly vehicles |

| 3-Wheeled Vehicles | 28% | 18% | Support for small transport operators | |

| Motorcycles (350 cc & below) | 28% | 18% | Lower cost for commuters | |

| Motor Vehicles for Transport of Goods | 28% | 18% | Relief for logistics sector | |

| Education | Maps, Charts & Globes | 12% | Nil | Learning tools tax-free |

| Pencils, Sharpeners, Crayons & Pastels | 12% | Nil | Affordable stationery | |

| Exercise Books & Notebooks | 12% | Nil | Boost for students | |

| Eraser | 5% | Nil | No tax on basics | |

| Electronics | Air Conditioners | 28% | 18% | Relief for households |

| Television (above 32”) including LED & LCD | 28% | 18% | Affordable entertainment | |

| Monitors & Projectors | 28% | 18% | Boost for offices & education | |

| Dish Washing Machines | 28% | 18% | Lower appliance costs |

Conclusion

The Next-Gen GST Reform 2025 is a game-changer for India’s economy. It not only reduces the cost of essential goods and services but also empowers farmers, supports students, makes healthcare more affordable, and strengthens industries. By lowering GST rates across sectors, the government has ensured that the benefits reach every household and business. This reform is expected to drive consumption, boost MSMEs, and pave the way for an Aatmanirbhar Bharat.